insulin collection boots landing, leading enterprises how to break through?

Policy Interpretation

the second and third generations of insulin were all included in the collection and were divided into 6 groups. Each generation was divided into three groups: quick-acting, basic and premixed according to the length of insulin effect.

from the quotation rules, the enterprise name plus the generic name is the unit to carry out competition, group competition, group quotation. The same enterprise and common name products are regarded as one bidding unit, and the quotation should be the same (e. g. midwinter premixed 30R, 50R).

, from the reporting rules, unlike chemical generic drugs, which only report the quantity according to the generic name, in insulin national procurement, first of all, medical institutions will report the quantity according to the "variety + brand,this approach directly prevents new insulin players from entering the market, for existing players, good production capacity is sufficient, market share is originally high, high coverage of medical institutions leading enterprises.

from the winning rules, the winning bid is divided into group a (half of the enterprises with the lower bid price), group c (the highest bid price) and group B (the rest of the winning enterprises except a and c) according to the price quoted by the enterprises. the quantity includes "basic quantity + increment". different quantities are allocated according to different groups:

1) The basic gauge is as follows: Group A gets 100 percent of the quoted amount from medical institutions, the rest gets 80% of the quoted amount, Group B gets 80% of the quoted amount, and Group C gets 50% of the quoted amount.

2) The incremental rule is as follows: the remaining 30% of the reported quantity in Group C is allocated to any selected enterprise in Class A as an increment, and medical institutions can choose independently; 80% of the reported quantity of the unsuccessful enterprises shall be independently selected by the medical institutions, which shall be allocated to any Class A and Class B enterprises, and the quantity allocated to Class A enterprises shall exceed that of Class B enterprises.

quantity part stabilizes the medication structure. As long as the quotation enters Group B, 80% of the quotation is guaranteed. The incremental part encourages price-for-quantity exchange. In order to obtain more incremental distribution, Group A entering the low-price area is the best choice.

In addition, medical institutions are also linked to the production capacity of insulin production enterprises. When the reported quantity exceeds 50% of the domestic production capacity supplied by enterprises, medical institutions will no longer be accepted.

the above-mentioned reporting method has a large coverage of enterprises, it will stabilize the short-term market-wide drug use structure, but it also encourages enterprises to enter Group A to obtain relatively more incremental distribution.

, on November 5, Shanghai, the local government, took the lead in issuing the collection document, firing the first shot of insulin collection.are disclosed: the procurement cycle will be 2 years, the procurement volume of the whole country and provinces will be disclosed, and the price of the product will be guided: the declared price of the product is less than or equal to 1.3 times the lowest quotation of the same procurement group, and if the standard is not met, the declared price will be reduced by 40% or more on the basis of the highest quotation of the same procurement group, and the winning qualification will be obtained. Judging from the current policy in Shanghai, the effect of price reduction may be more obvious than expected.

Diabetes Drug Market Broad

prevalence and treatment rate increased year by year

affected by diet and rest habits, living standards and the aging of the population, the incidence of diabetes in the modern population is on the rise. According to the International Diabetes Federation (IDF), the number of adults with diabetes worldwide more than tripled from 0.151 billion in 2000 to 0.463 billion in 2019. It is estimated that 0.578 billion people will develop diabetes in 2030, and the number will exceed 0.7 billion in 2045.

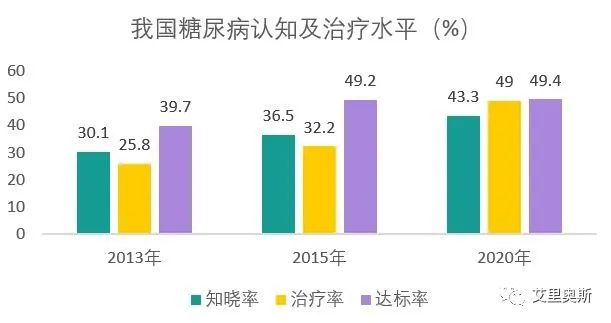

my country is the country with the largest number of diabetes patients in the world. The total number of diabetes patients in 2019 was 0.116 billion, and the prevalence rate is still rising, reaching 11.2 from 2015 to 2017. It is estimated that 0.141 billion people will suffer from diabetes in 2030. Diabetes awareness (36.5 per cent), treatment (32.2 per cent) and control (49.2 per cent) rates have improved in recent years, but remain low. From the type of diabetes in the population of T2DM accounted for more than 90%.With the increase of prevalence and treatment rate, the population of diabetic disease will further increase.

Chart 1 Awareness, treatment and compliance rates of adults diagnosed with diabetes in China.

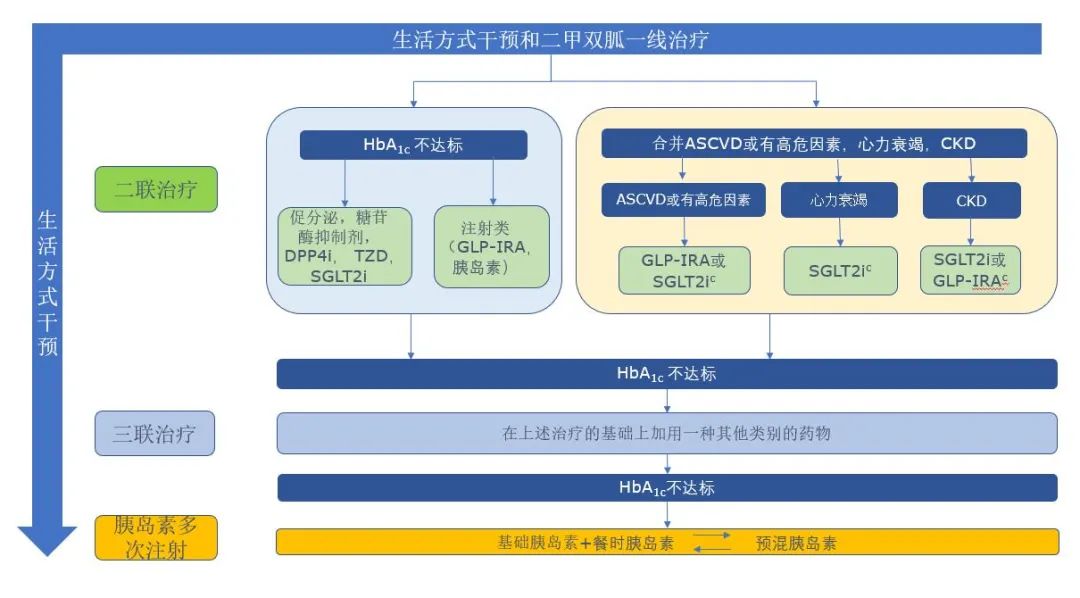

insulin is the second-line mainstream of diabetes treatment

collection leads to a decline in the size of the insulin market.

from the perspective of treatment path, the first choice for the treatment of diabetes is still oral hypoglycemic drugs, insulin is the first choice for second-line treatment, and the proportion of drugs is about 40%, while the market share of new hypoglycemic drugs represented by GLP-1RA is gradually increasing. The natural decline in the combined use ratio, once it enters the collection and spreads across the country, the insulin market share will decline faster than other varieties,the impact of policy factors such as the upcoming insulin collection, the overall size of China's insulin market will be reduced by the impact of lower prices.

Chart 2 T2DM Treatment Pathways [1]

http://www.hnysfww.com/data/article/1619222032934605040.pdf

Chart 3 Changes in sales-side market share of diabetes drugs.

insulin market

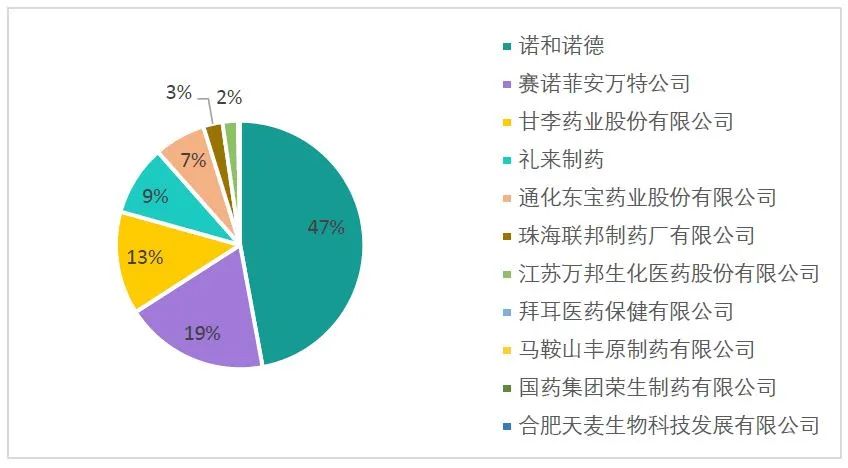

head enterprises occupy half of the country

collection policy will affect the competitive landscape

Chart 4 Market Share of Insulin Companies in 2020

insulin set post-harvest market share or will be reshuffled

Accelerating the process of domestic substitution

Among the domestic manufacturers, Ganli Pharmaceutical, Tonghua Dongbao and Federal Pharmaceutical are the main domestic players. Among them, Ganli Pharmaceuticals to the third generation of insulin products-based, Tonghua Dongbao and federal pharmaceuticals to the second generation-based.

national collection rules are expected to be relatively mild, and price information is subject to further disclosure. Judging from the previous pilot in Wuhan, the price drop is relatively limited, while this centralized purchase gives more opportunities to enterprises with different bids. Even if it is not the lowest price, there is still a certain purchase volume guarantee. In addition, because the price of domestic insulin is about 20% lower than that of imported products, the quotation has a better chance to enter Group A, and more basic and incremental distribution can be obtained in the future. When the collection of boots landed with a certain degree of insulin prices down, whether imported or domestic enterprises, should pay more attention to reducing cost efficiency,Recommended Selection When Selecting Upstream Productsquality is guaranteed andhigh-quality domestic suppliers with relatively low cost.

WeChat Public Number

Arios

Contact Us

marketing@aliothbio.com