Dapeng, with the wind rising in the same day, soared to 90,000 miles-the next part: biopharmaceutical expansion boosts filtration industry on the fast track

01

biopharmaceuticals and Medicare payments

promotes the prosperity of filtration market

biological agents and macromolecular drugs

biologics are genetically engineered proteins made of nucleic acids, sugars and even cells and tissues. The U.S. FDA approved the first monoclonal antibody drug in 1986 and the 50th in 2015. In the following six years, the 100th monoclonal antibody has been approved this year. The domestic biological drug pipeline has also increased rapidly from the past two years to nearly 1600, with 28 approved monoclonal antibodies. Monoclonal antibodies are therapeutically advantageous, and many pharmaceutical companies have multiple monoclonal antibodies in their development pipeline. While filtration technology plays an important role in the recovery of different biological agents and macromolecular products, it is used to purify molecules with minimal process changes. Therefore, the global rise in the production of biologics and macromolecules will drive the demand for pharmaceutical filtration products, thereby contributing to the market growth.

biopharmaceutical industry

the urgent need to introduce new biologics, vaccines and proteins with sterility and zero risk of contamination necessitates the use of advanced drug filters. With the penetration of biologics in the field of disease treatment, production and marketing continue to grow globally, especially in developing countries. At present, a large number of drugs entering the market are biopharmaceuticals. In terms of R & D pipeline, biopharmaceutical R & D pipeline accounts for 40% of the total drug pipeline. In addition, biosimilars are also growing rapidly in the biopharmaceutical industry in emerging economies such as China and India. Therefore, the expansion of the biopharmaceutical industry, especially in emerging economies, has played an important role in the growth of the pharmaceutical filtration market.

to increase government health spending

Globally, governments in all regions have increased their spending on health care. For example, according to Medicare and Medicaid Services, US national health expenditure (NHE) reached $3.3 trillion billion in 2016, accounting for 17.9 per cent of GDP, while US health expenditure increased by 4.3 per cent, while UK health expenditure increased by 3.6 per cent in the same year. In recent years, China's medical insurance expenditure has also increased by about 10% every year, and its proportion in total GDP has also increased to 7% year by year. It is estimated that about 30 per cent of healthcare spending will go towards upgrading infrastructure. Therefore, in the near future, it is expected that the increase in national health care expenditures will drive the growth of pharmaceutical filtration products.

02

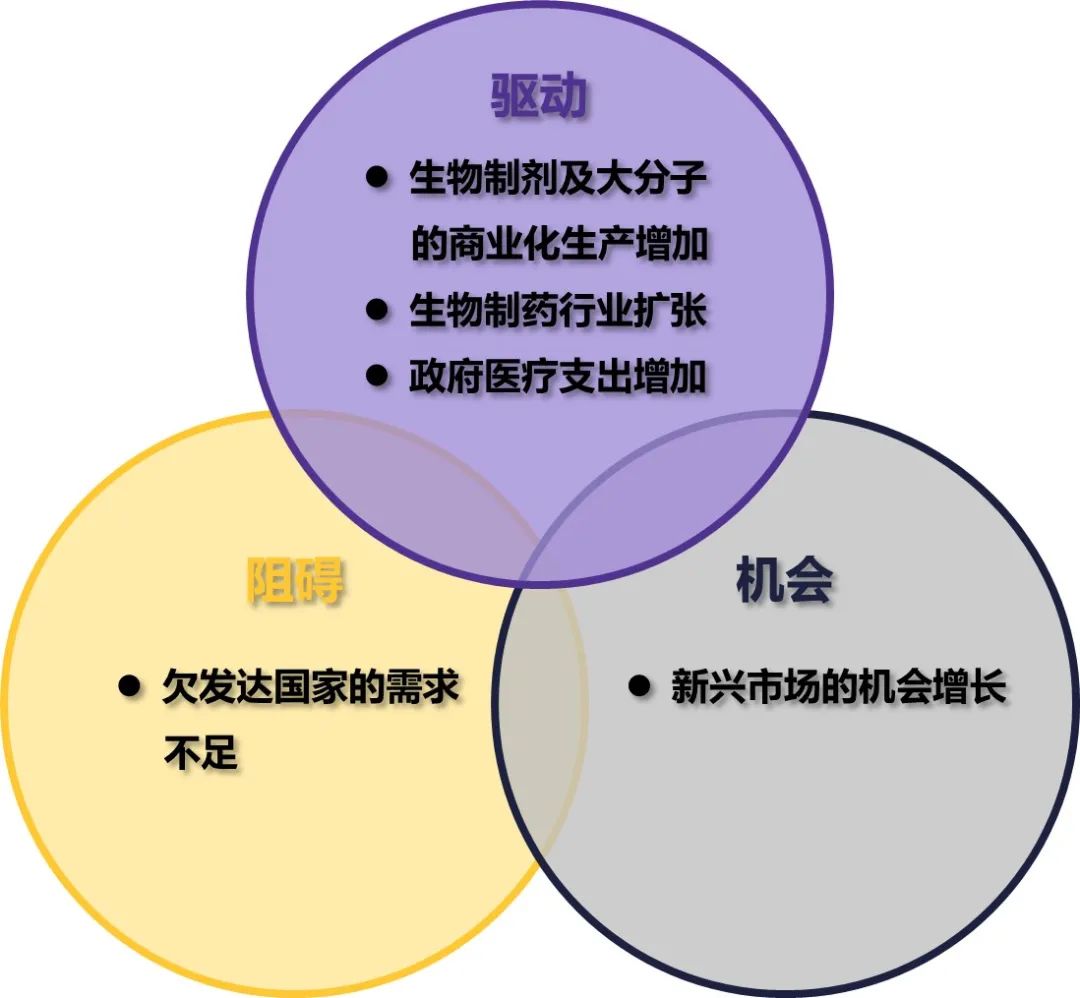

constraints and opportunities

Weak demand in less developed countries constrains development

lack of financial resources, low income, low number of pharmaceutical companies, and lack of advanced manufacturing systems hinder the growth of the drug filtration market in less developed countries, such as Asia and Africa. In addition, inadequate government agencies' support for advanced filtration products in the pharmaceutical and biopharmaceutical industry and lack of trained professionals are hindering the growth of the pharmaceutical filtration market in less developed countries such as Ethiopia, Afghanistan, Guinea, etc.

Growth Opportunities in Emerging Markets

Due to the improvement of the infrastructure of the pharmaceutical industry, the increase in the number of pharmaceutical industries, and the increased demand for pharmaceutical filtration products, the growth of the pharmaceutical filtration market is expected to be driven by opportunities in untapped emerging markets. The health care industry in emerging economies is growing at a high rate due to increased demand for better advanced manufacturing products and massive government investments to improve health care infrastructure. In addition, other emerging markets such as China and India are also hubs for pharmaceutical companies, providing potential opportunities for growth in this market.

In general, the impact of the drivers of the filtration market is expected to outweigh the impact of the obstacles. Therefore, the filtration market of the global pharmaceutical industry is expected to grow at a compound annual growth rate of about 5% from 2020 to 2025, while China still maintains a high growth rate of more than 20%.

Figure 8. Impact analysis

03

Domestic filtration industry

the rapid rise of many emerging enterprises

, filter membrane products began to appear in China in the 1960 s. The development time is late, the technology is not as mature as that of Europe and the United States, many enterprises are small in scale, and the product quality still cannot meet the needs of the biopharmaceutical industry. Under this background, with the rapid development of biopharmaceuticals and the drive to upstream supply, some enterprises have emerged that can apply filtration products and technologies in biological processes and replace imported products, more companies began to enter the international market.

multinational enterprises are the main players in the market at present, and the market share accounts for the vast majority. The main players include Merck, Pall, saidolis and so on, which are in a strong position of filtering products.

Figure 9. Filtering product layout of multinational enterprises

domestic biological filtration, separation and purification enterprises are developing rapidly, and filtration product lines are constantly enriched, including one-time ultrafiltration system and virus removal filtration. With the gradual recognition of domestic brands by the market and the advantages in supply chain, emerging domestic enterprises such as Arios are also rapidly entering the track and gradually becoming market players with strong filtration competitiveness.