's new crown: therapeutic drugs "take over" new crown vaccine

Click on the blue above to pay attention to us •

01

epidemic: incoming company performance.to fly.

the new crown epidemic has been spreading around the world for more than 2 years, around the detection of the new crown virus, vaccine production and sales and pharmaceutical intermediates and other links of a number of enterprises have also been full of harvest, the performance increased significantly. In particular, the vaccine industry has received unprecedented exposure and development, from the outbreak of the performance of vaccine companies to the emergence of new mRNA technology vaccines, which is also a positive side of the crisis brought about by the new crown epidemic, which has promoted the development of the entire vaccine industry.

a number of vaccine companies in China actively entered the market to carry out vaccine research and development when the new crown began to emerge. For example, Beijing Kexing, before 2020, most people may have never heard of it. But after the outbreak of the new crown, Kexing ushered in the highlight of its history, from obscurity to well-known, the development and sales of the new crown vaccine let its performance rise like a rocket. Full-year revenue of $0.246 billion in 2019, full-year revenue growth of 108 percent in 2020 and even more 3694 percent in 2021, with net profit attributable to the company increasing approximately 80 times, achieving revenue of $19.375 billion and net profit of $14.459 billion. This year alone is equivalent to the sum of Hengrui Pharmaceuticals for seven consecutive years from 2015 to 2021.

in addition, like Zhifei Bio, Kangshino, Kangtai is also in the development and production of vaccines, layout production capacity, from 20 years of performance has also begun to advance by leaps and bounds.However, with overcapacity and weak demand for the new crown vaccine, how can the high growth in performance be sustained?

Table 1. Changes in the performance of companies listed on the new crown vaccine

02

's new crown: the vaccine feast is nearing its end

sudden historical process, there will eventually be a moment of calm., Kangtai Bio released its 2022 first-half performance forecast. It is expected that the net profit attributable to the parent in the first half of the year will be 0.1 billion yuan to 0.13 billion yuan, a year-on-year decrease of more than 60%. As for the reasons for the sharp decline in performance, the company explained that it was mainly due to asset impairment and costing of research and development expenses, as well as the rapid decline in sales of the new crown vaccine. Kangtai biological thunderstorm in the release of a signal, the industry demand inflection point may be coming, if the epidemic demand decline, those vaccine companies have been on the production capacity of how to digest.

domestic and foreign vaccination rate is high, the remaining market space is limited..

As of July 2022, China's full basic immunization coverage rate is 89.5 per cent and the enhanced immunization coverage rate is 56.3 per cent; among them, for the elderly group over 60 years of age, the proportion of completed one dose/full vaccination/enhanced immunization is 88.6 per cent/83.8 per cent/65.7 per cent, respectively.the domestic vaccination rate is quite high, the follow-up demand will mainly come from the vaccination of booster needles. But without a clearer policy calling for an increase in the frequency of booster vaccinations, the level of demand for the new crown vaccine in 2022 will decline rapidly compared to last year.

not only domestic but also foreign markets have shrunk, with exports of the new crown vaccine declining significantly year-on-year, with 66.3 per cent of the global population receiving at least one dose of the new crown vaccine as of June 20, 2022. In terms of export data, China's exports of vaccines for use in January-June 2022 amounted to 5.11 billion billion yuan, down 84% year-on-year.

domestic sales + export mode, China's domestic vaccine supply, from 2021 domestic injection plus export volume of nearly 5.5 billion doses, the first half of 2022, domestic and foreign consumption of only about 0.83 billion doses, on average, the total demand in the first half of the decline of 63%, the market contraction is obvious.

In addition,from the national policy direction can also be seen, the vaccine industry in strict control of access to prevent industry overcapacity problems., the State Food and Drug Administration issued the "Regulations on the Administration of Vaccine Production and Circulation" to strictly control the newly established vaccine production enterprises and control the new production capacity of vaccines. Enterprises that do not have the capacity to produce can entrust stock vaccine manufacturers to produce.

viruses continue to evolve, vaccine iterations can't keep up.

because the new coronavirus is an RNA virus, its mutation speed, significantly enhanced transmission capacity, the emergence of the Omicjon strain quickly replaced Delta, as the world's main epidemic of the new coronavirus strain. In the World Health Organization's weekly report on the outbreak, published on 11 May, a summary of 23 studies assessing the effectiveness of existing neo-crown vaccines in protecting against infection with the Omicjon strain was presented. The results showed that routine vaccination with the new crown vaccine was less effective in preventing infection with the Omicjon strain, symptomatic infection and severe illness than the other four new crown variants classified as "need to be concerned", such as the alpha strain. However, the effective rate of preventing severe illness caused by Omykjon is still very high.

new crown vaccine does not keep pace with the continued evolution of the virus, it is prone to immune escape, coupled with the gradual mutation of the virus in the direction of high transmission but declining rates of serious illness and lethality,has also led to a decline in the population's willingness to vaccinate. The impact on vaccines from the demand side is also shocking.

The golden age of domestic vaccines is in decline, how companies can break the situation..

has experienced its heyday, domestic vaccine companies have also accumulated a large amount of cash, laying a good financial foundation for future innovation and development, and is expected to accelerate the development of other pipelines. At the same time, the effectiveness and safety of vaccines on many different technology platforms have been verified, which will help to apply innovative vaccine development technology platforms to other disease areas and develop more effective and safer vaccines.

in existingexperience and resources,companies have two paths forward, one is to continue the research and development of the new crown vaccine, but because it is too much of a case now, it is possible to consider differentiating from the way of vaccination and the population to be vaccinated., such as focusing on children's vaccines and nasal spray vaccines, which are more convenient to vaccinate.is to change our thinking and develop other vaccines., especially vaccines for diseases that cannot meet the needs at present, such as cancer, addictive diseases, allergic reactions, diabetes, Alzheimer's, HIV, etc., are expected to form breakthrough therapies and create greater market value.

03

landscape is quietly changing: the rise of new crown treatment drugs.

Due to the rapid mutation of the virus, the speed of vaccine development cannot quickly keep up with the iterative speed of the virus, resulting in the failure of prevention,new crown drugs are the last piece of the puzzle to complete the closed loop of epidemic prevention and control. In particular, small molecule drugs, with the whole domain, than the specificity of neutralizing antibodies in the rapid mutation of the virus can play a better role.

New Crown Therapeutic Drugs Approved for Listing.

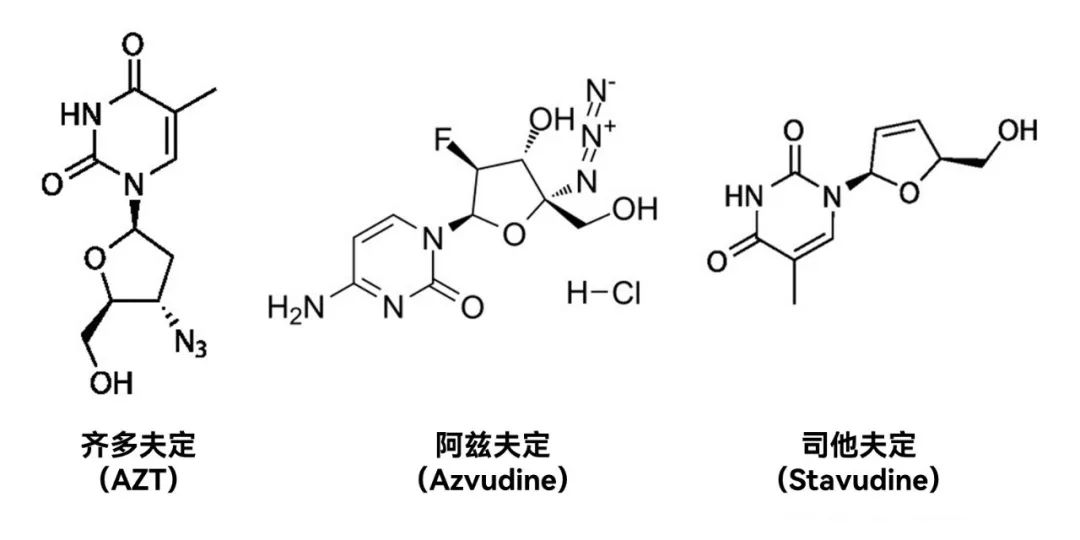

the world has been listed more than ten new crown treatment drugs, China's listed 3, of which imported Pfizer 1, domestic 2. Tengsheng Bo's neutralizing antibody combination therapy was approved for listing in China on December 8, 2021, and is the first neutralizing antibody therapy listed in China. Andreal creatures, will be available on July 25, 2022, and is the first small molecule therapeutic drug to be listed in China, with mileage cup significance.

Azvudine tablets can significantly shorten the symptom improvement time of patients with moderate novel coronavirus infection pneumonia, increase the proportion of patients with clinical symptoms improvement, and achieve clinical excellent results. If calculated on the basis of a course of 35mg and the reference AIDS indication price of 25.86/mg, each course of treatment costs about 900 yuan, lower than the current domestic approved Pfizer paxlovid of 2300 yuan per course of treatment, will be conducive to China's new crown epidemic prevention.

data source: Pharmaceutical Rubik's Cube, ClinicalTrials

Table 2. Global approvals of new crown therapeutic drugs amount to more than 10

small molecules in the research pipeline progress can be expected.

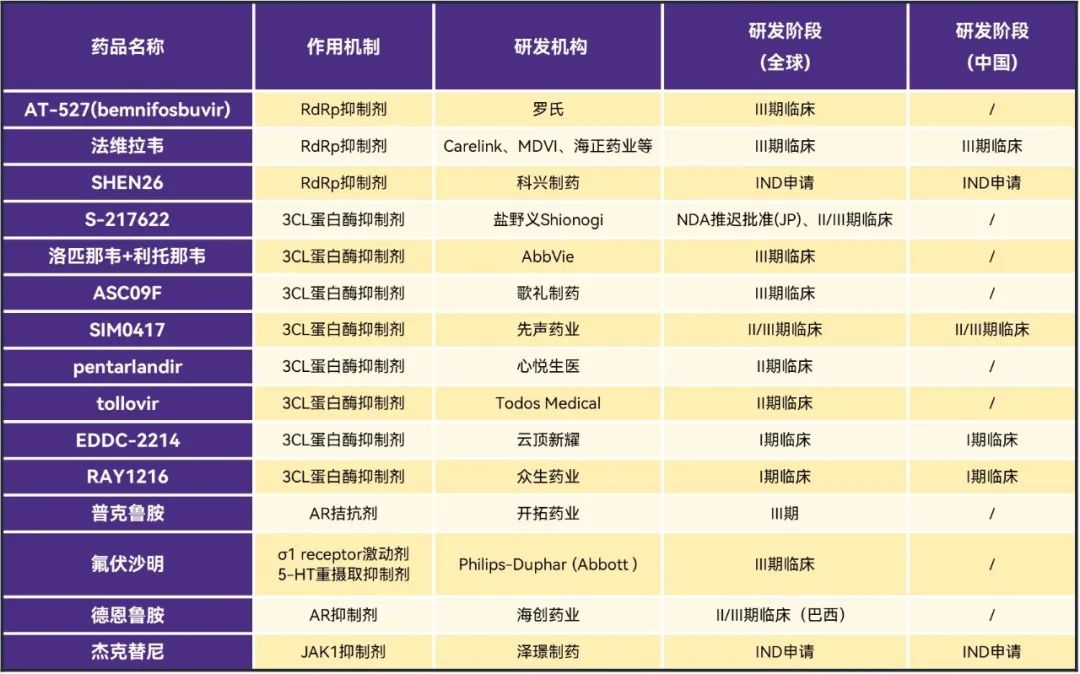

, from the current new coronary pneumonia treatment drug market, small molecules are the focus of attention, and several enterprises have begun to lay out. In addition to the listed drugs, about 15 R & D pipelines around the world have entered the clinic, including 10 R & D pipelines involving Chinese enterprises. The market is waiting for the release of clinical data of relevant drugs, but the effectiveness and safety are still important indicators for each enterprise to decide the outcome, it remains to be seen whether its drugs will eventually be able to gain a foothold in the market.

from the perspective of therapeutic mechanism, the research and development of the new crown oral drug mainly focuses on the RdRp inhibitor represented by monelavir and the 3CL protease inhibitor represented by Paxlovid, both of which account for the main force of the research and development pipeline, and there are also some research and development projects to explore other mechanisms such as AR antagonists and JAK1 inhibitors.

data source: Pharmaceutical Rubik's Cube, ClinicalTrials

Table 3. The latest global clinical research progress of new crown oral drugs

In addition to entering the clinical stage of R & D projects, some domestic companies are still in more projects in the pre-clinical stage of R & D. For example, Yunding Xinyao, Geli Pharmaceutical, Junshi and so on.

data source: Pharmaceutical Rubik's Cube, ClinicalTrials

Table 4. List of preclinical projects of new crown small molecule drugs in domestic enterprises

New Crown Drugs Drive Upstream and Downstream Development of the Industry Chain.

the listing of real biomolecules, Fosun Pharma has signed a strategic cooperation to obtain exclusive commercialization rights. The cooperation areas include all areas related to the treatment and prevention of new coronavirus and AIDS in Azvudine. The cooperation areas are in China (excluding Hong Kong, Macao and Taiwan) and most of the global regions (excluding Russia, Ukraine, Brazil and other South American countries and regions). The company pays a total of about 0.8 billion heads of real creatures, and will receive a 50%-55% sales share depending on the sales area. With Fosun's strong commercialization capabilities at home and abroad, the real creature Azvudine will be able to rapidly advance the release.

around the new crown treatment drug research and development, the industry chain upstream and downstream enterprises can share a piece of the pie.For example, with real biological signed upstream raw material supply and midstream drug production related enterprises, such as China Resources Shuanghe, Aoxiang Pharmaceuticals, etc., downstream has China and overseas countries product distribution of cooperative enterprises Fosun Pharmaceuticals, deep participation in the new crown treatment drug supply chain CDMO enterprises, Kelaiying, Botten shares and so on.in the follow-up potential orders and other domestic oral drug clinical progress continued to catalyze, the scale of the upstream and downstream industrial chain will be further expanded, the relevant companies are expected to usher in performance.