of China's innovative drugs going to sea?

Click on the blue above to pay attention to us •

In recent years, domestic innovative drugs seeking overseas development are in the ascendant. On the one hand, domestic pharmaceutical companies continue to increase investment in research and development, rapidly increasing the number of domestic innovative drugs IND, for the local new drug "sea" to provide a large number of candidate drugs. On the other hand, by the volume of procurement, health insurance negotiations, research and development homogenization and other factors, the domestic innovative drug competition pattern gradually rolled in, further catalyzing domestic pharmaceutical enterprises to the international market.

At the same time, in May 2017, China joined ICH. For Chinese innovative drugs to go to sea, synchronous declaration can be realized through global multi-center clinical research. According to ICH E5 (R1) guidelines, Chinese clinical data can also be used. After evaluating that the data meets the regulatory requirements of the region to be declared and at the same time evaluating that the data can be extrapolated to the region to be declared without being affected by ethnic factors, it seeks overseas registration and listing. Multi-share force to promote China's new drug "sea" continues to heat up, then the current and present what characteristics, the current situation of the sea enterprises?

antineoplastic drugs accounted for 70%, innovative enterprises involved in more

, from the perspective of the field of treatment, antineoplastic drugs are the most popular "sea-going" varieties, accounting for about 70% of the total sea-going drugs.on the one hand, it reflects the strength of domestic pharmaceutical companies in the research and development of anti-tumor drugs; on the other hand, it also shows that in the face of fierce competition in the domestic market, companies strive to seek increments in overseas markets, and anti-tumor drugs are mostly PD-1 monoclonal antibodies and ADC drugs.

Up to now, the domestic has been approved for the listing of 14 PD-1/L1 monoclonal antibodies, 1 PD-1 plus CTLA-4 double resistance, 5 domestic PD1/L1 monoclonal antibodies and the first domestic PD-1/CTLA-4 double resistance for the first time to get health insurance negotiations. At the same time, the PD-1 domestic "four little dragons" (carelizuzumab, shindilizumab, treprozumab, trellizumab) a total of 12 indications of medical insurance to be discussed, the price war will start again.

the fierce competition in China, it has become the choice of many enterprises to enter the American market with strong payment ability. Since the beginning of this year, nine domestic PD-1/L1 drugs have begun to try to "go out", mainly through independent sea, that is, the progress of foreign declaration and the progress of foreign clinical trials.

After PD-1/L1 drugs, ADC drugs have led the second wave of innovative drugs in China, but they have also raised concerns about the layout of their targets (such as HER2, EGFR, TROP2, Claudin18.2, c-Met, etc.). At present, 5 ADC drugs have been approved for listing in China, and there are as many as 13 ADC candidate drugs in Phase III. It is expected that the country will usher in an outbreak period of ADC drugs within 2 to 3 years, and will also face fierce competition. Unlike PD-1 mAbs, the "sea" of ADC drugs mainly depends on License-out. Since the beginning of this year, Colon Pharmaceuticals, Stone Pharmaceutical Group and Li Xin Pharmaceuticals have all reached relevant authorization transactions. In particular, Kelun Pharmaceutical, its holding subsidiaries Kelun Botai and Merck have reached two transactions in more than two months.

from the composition of the "sea" pharmaceutical companies, innovative pharmaceutical companies are the absolute main force.According to incomplete statistics, 139 innovative drugs in China are undergoing 233 clinical trials overseas, belonging to 38 listed companies. According to the number of clinical trial projects, more than 10 companies include: Baiji Shenzhou, Hengrui Pharmaceuticals, Gacos, Kangfang Bio, Fosun Pharmaceuticals, Yasheng Pharmaceuticals, etc. In addition to a few large pharmaceutical enterprises in the sea only Hengrui Pharmaceuticals, Stone Pharmaceutical Group, Green Leaf Pharmaceuticals, Kelun Pharmaceuticals, etc., and innovative pharmaceutical enterprises not only have such head enterprises as Baiji Shenzhou, Cinda Bio, Junshi Bio, there are many start-ups that have not yet entered the commercialization stage.

emerging biopharmaceutical companies have become the most important force in domestic drug research and development. A report recently released by IQVIA shows that in China, emerging biopharmaceutical companies (EBP, biopharmaceutical companies with annual sales revenue of less than US $0.5 billion and annual R & D investment of less than US $0.2 billion) participate in 83% of new drug development activities, far exceeding other major pharmaceutical markets. In Europe, EBP is involved in 47% of drug development activities. In the United States, nearly 2/3 of research and development activities are related to EBP enterprises. In Japan, EBP enterprises contribute only 22% to the research and development line.

However, at present, most of the products of innovative pharmaceutical companies are still in the early clinical stage. The new developments released by "going to sea" are mostly concentrated in foreign approved clinical trials, foreign clinical progress (such as the completion of the first patient administration or clinical enrollment), foreign declaration progress (such as obtaining orphan drug qualification) and other types, which are still a long way from the commercialization stage.

Clinical data is insufficient, and it is difficult to go to sea independently.

Although the independent sea of innovative drugs is a major point of view of innovative drug enterprises, but from the situation of enterprises going to sea in recent years, the road of domestic pharmaceutical enterprises to sea is not smooth, conbercept, xindilizumab and so on have been blocked one after another. The reasons are different. Sindilizumab and Plinabulin both lack international multi-center clinical trial data representing the U.S. patient population. Treplimumab and Ebegastin α Injection were blocked mainly due to the new crown epidemic. The overseas trials of Compaq were affected by the epidemic, a large number of patients fell off, and more than half of the subjects were not as effective as expected.

local innovative drugs to go to sea. The first is "new", the product or treatment plan has characteristics and can meet unmet clinical needs; the second is "early", starting from the first day of the product project. Preparations for going to sea run through preclinical, clinical, CMC (chemical composition production and control), production, etc.the exploration process of innovative drugs going to sea is a learning for all Chinese companies. Although they have encountered some difficulties temporarily, in the long run, innovative drugs going to sea is an inevitable trend after domestic pharmaceutical companies have developed to a certain extent.

the success of zebutinib can also provide reference experience for domestic pharmaceutical enterprises to go to sea.differentiated products, strong capital and strong overseas team are hard conditions.differentiated products can meet the unmet clinical needs; Global multi-center clinical trials are very expensive. Therefore, strong capital is a necessary condition for clinical development. In addition, foreign registration runs through all links and requires strong overseas team support: technical personnel, global multi-center clinical trial personnel, regulatory registration personnel, etc. are indispensable.

Table 1. Cases of domestic innovative drugs blocked from going to sea

Data source: National Health Commission, OECD

License out is getting better and better, becoming the mainstream model.

is different from independent research and development, License out through cooperation with overseas pharmaceutical companies, not only in the research and development side to achieve complementary advantages, reduce the risk of new drug research and development, but also in the sales side with the help of the sales network of major international pharmaceutical companies, so that domestic innovative drugs faster into the international market, to obtain rich cash flow returns. Considering that at this stage, most of China's innovative pharmaceutical enterprises have not established overseas and cannot establish mature R & D and sales teams, License out can be an effective strategy for the globalization of innovative pharmaceutical enterprises.

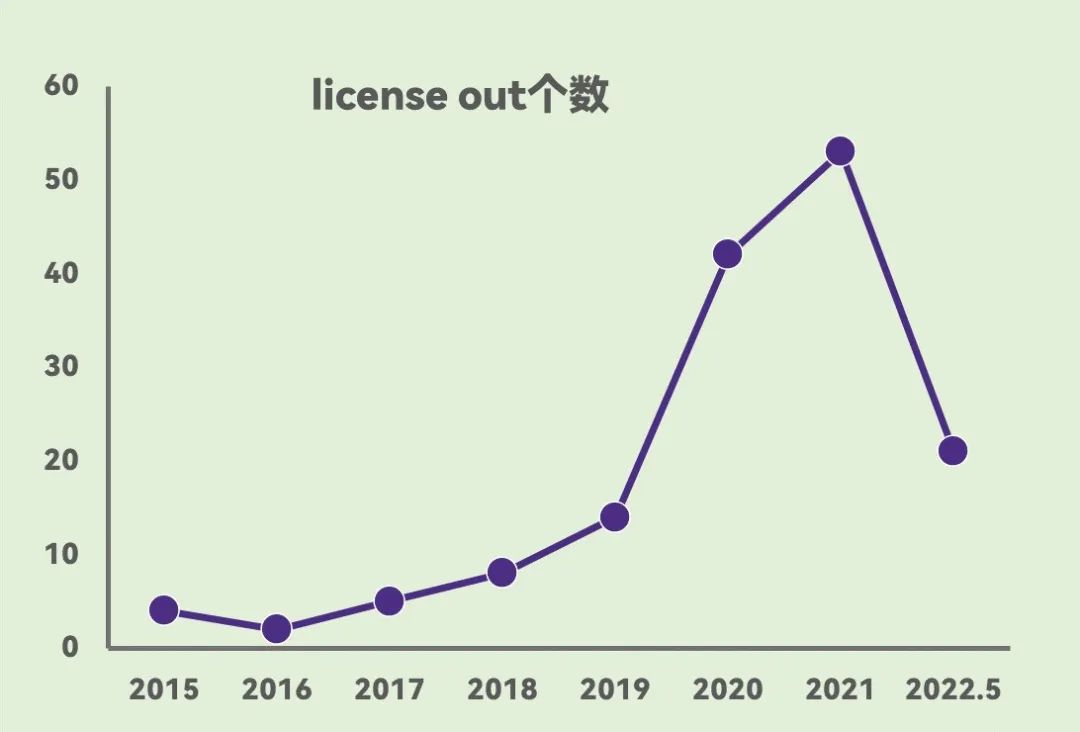

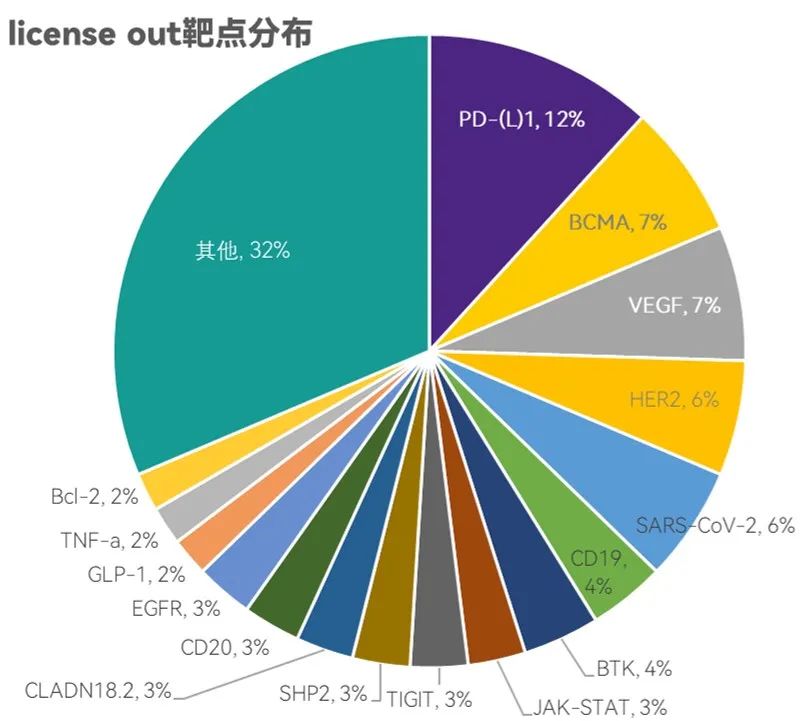

innovation targets are emerging, moving from sales authorization to deep integration of R & D/sales.With China's formal accession to ICH in 2017, License out transactions are becoming more and more active. As of May 2022, domestic companies License a total of 149 out-of-trading projects. In terms of target distribution, PD-(L)1 is still the most popular target, followed by BCMA, VEGF, HER2, CD19, etc. In addition, some innovative targets such as TIGIT and SHP2, as well as some dual-resistance projects and CAR-T projects, are also gradually starting overseas licensing tours. Among them, Fuhong Hanlin, Baiaotai, Cinda Bio completed 8, 7 and 5 authorizations, respectively, biosimilar drug commercialization authorization progress rapidly. Hengrui Pharmaceuticals, Baiji Shenzhou, etc. with a wealth of pipelines and innovative targets, License out tend to research and development cooperation to promote the overseas layout of products.

Figure 1. Rapid growth in the number of License out transactions

Figure 2. License out target PD-(L)1 is the hottest

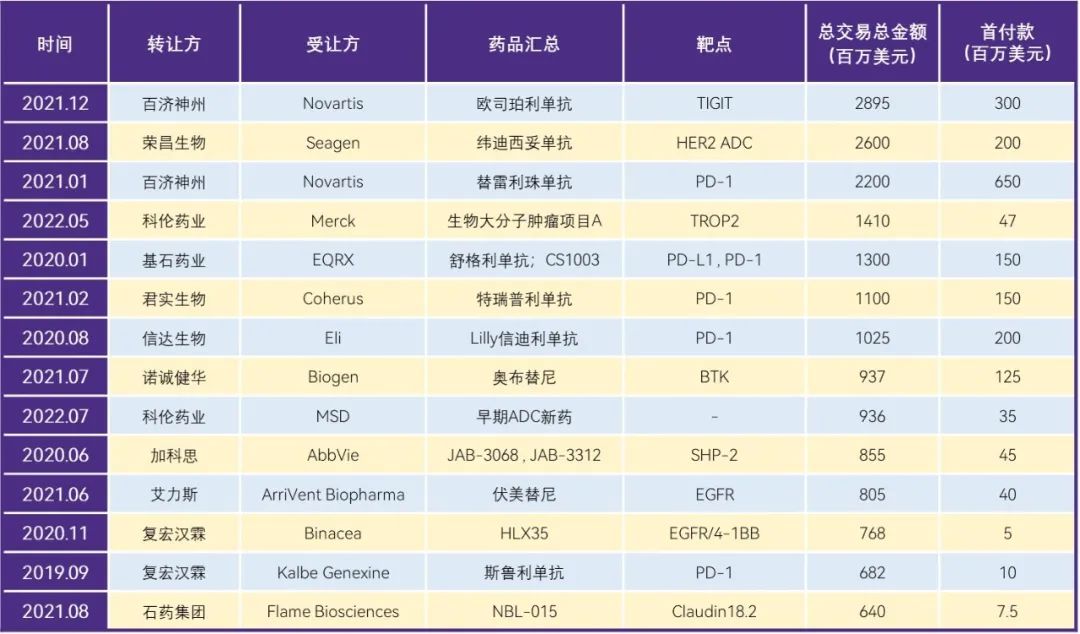

transaction amounts are constantly refreshed.With the steady increase in the international recognition of domestic innovative drugs, the amount of out-of-License domestic innovative drugs continues to rise. According to incomplete statistics, a total of 14 License out projects have a total transaction amount of more than US $0.5 billion, namely, osperlizumab (2.895 billion) and tirellizumab (2.2 billion) from Baiji Shenzhou, and weidicetuzumab (2.6 billion) from Rongchang Biology.

Table 2. License out over $0.5 billion transactions at a glance

Data source: Pharmaceutical Rubik's Cube, Southwest Securities

Although License-out is relatively easy compared to going out on its own and does not require a full-link self-built team, its transaction threshold is not low. It is reported that when foreign companies select products, they usually need cooperative products to enter clinical phase II, and overseas and local test data are also indispensable.

Major Biological Drugs Going to Sea

even if the independent sea faces many difficulties, local innovative drugs into the United States is not all bad news. This year, Legendary Bio's Cedarkeorensai and Tianji Pharma's Benvimod have been approved by the FDA. The former is the world's second approved BCMA targeted CAR-T therapy, by Johnson & Johnson responsible for foreign development and commercialization; the latter is the first FDA-approved steroid-free psoriasis topical drug, by the Dermavant responsible for the development of outside China.

According to the progress of listing, Zebutinib (2019.11) of Baiji Shenzhou and Levamlodipine Maleate (2019.12) of Shiyao Group are the first batch of domestic innovative drugs successfully approved by FDA for listing. Among the biopharmaceuticals, the legendary creature of 2022.2, was the first to go to sea successfully.

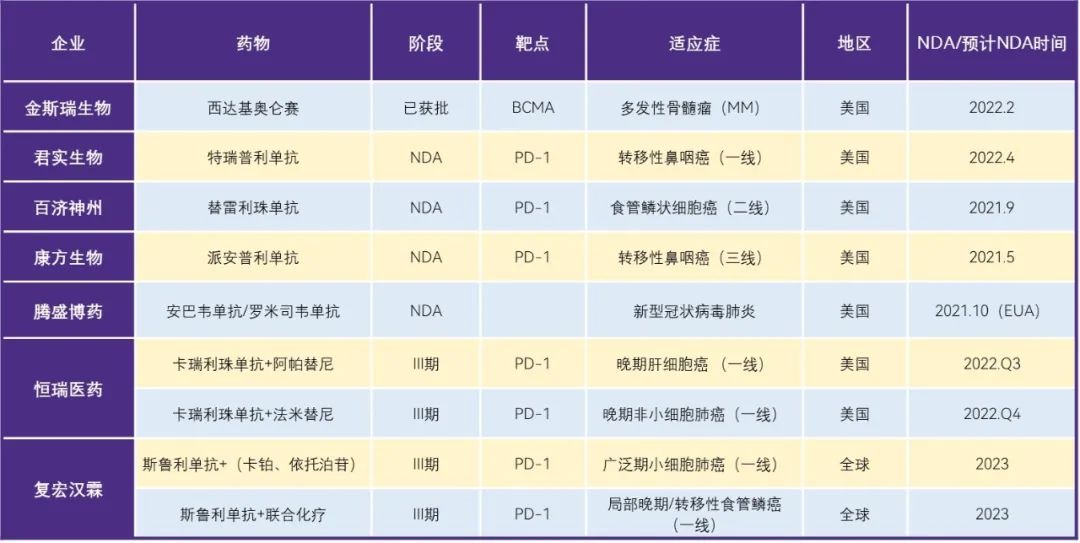

In addition to several drugs already on the market, among the 9 NDA and 33 Phase III clinical projects in the later stage, the key projects of NDA of biological drugs include several major PD1, including Baiji Shenzhou, Kangfang, Junshi, etc.; And ambavir monoclonal antibody/romisivir monoclonal antibody of Tengsheng Bo drug, etc. Phase III clinical projects are expected to be available in 2023-2024, including Hengrui Pharmaceuticals involving Carrilli zumab and Fu Hong Hanlin's Srulimumab.

Table 3. List of key biopharmaceutical projects leading the independent sea

data source: Pharmaceutical Rubik's Cube

for domestic innovative pharmaceutical enterprises, "going out" is not only a proof of their own R & D strength, but also the best choice for them to avoid domestic competition and find another way under the high capital R & D investment. In addition to some of the more mature pharmaceutical companies, such as Baiji Shenzhou, Green Leaf Pharmaceuticals, Kangfang Biology, Fuhong Hanlin and other sea-going efforts are quite large, by the ancestors in the sea exploration accumulated rich experience, some emerging innovative pharmaceutical companies to sea pace has further accelerated.