2021 pharmaceutical health investment and financing inventory.

Click on the blue above to pay attention to us •

policy and industry, continue the high growth trend.

2021, there were 1364 financing events in China's primary healthcare market, up 42% year-on-year, and total financing reached a record high of more than $35.6 billion, up 39% year-on-year. Compared with the capital explosion of the medical industry at the beginning of this year, the capital tended to calm down in the second and third quarters, and declined slightly in the fourth quarter.

, with the outbreak of the epidemic and the further deepening of the medical reform policy, the market demand for vaccines, innovative drugs, Internet medical care and so on has been further recognized. Capital enthusiasm for the pharmaceutical and health industry is still high, since 2020 the entire pharmaceutical and health investment has returned to the high growth channel, the pharmaceutical industry to drive the upstream industry has been rapid development.

Figure 1: China's pharmaceutical and health industry financing over the years.

investment region: the world to see the United States, China to see Shanghai

, from the perspective of the geographical distribution of financing amount, the United States is still the dominant position, 70.6 billion accounting for 55% of the world's total amount, while China has gradually become a major pharmaceutical investment country, accounting for 28% of the global total amount. Together with the United States to form an oligopoly, occupying more than 80% of the total market. Judging from the average amount of single financing, China is 0.028 billion billion US dollars, which is still a certain gap compared with the 0.042 billion in other parts of the world.

financing, are relatively small in terms of overall volume, ranging from 23 to 5.5 billion. The growth rate of the three countries in 2021 also reached more than 100.

Chart 2: Global Pharmaceutical and Health Industry Financing TOP3

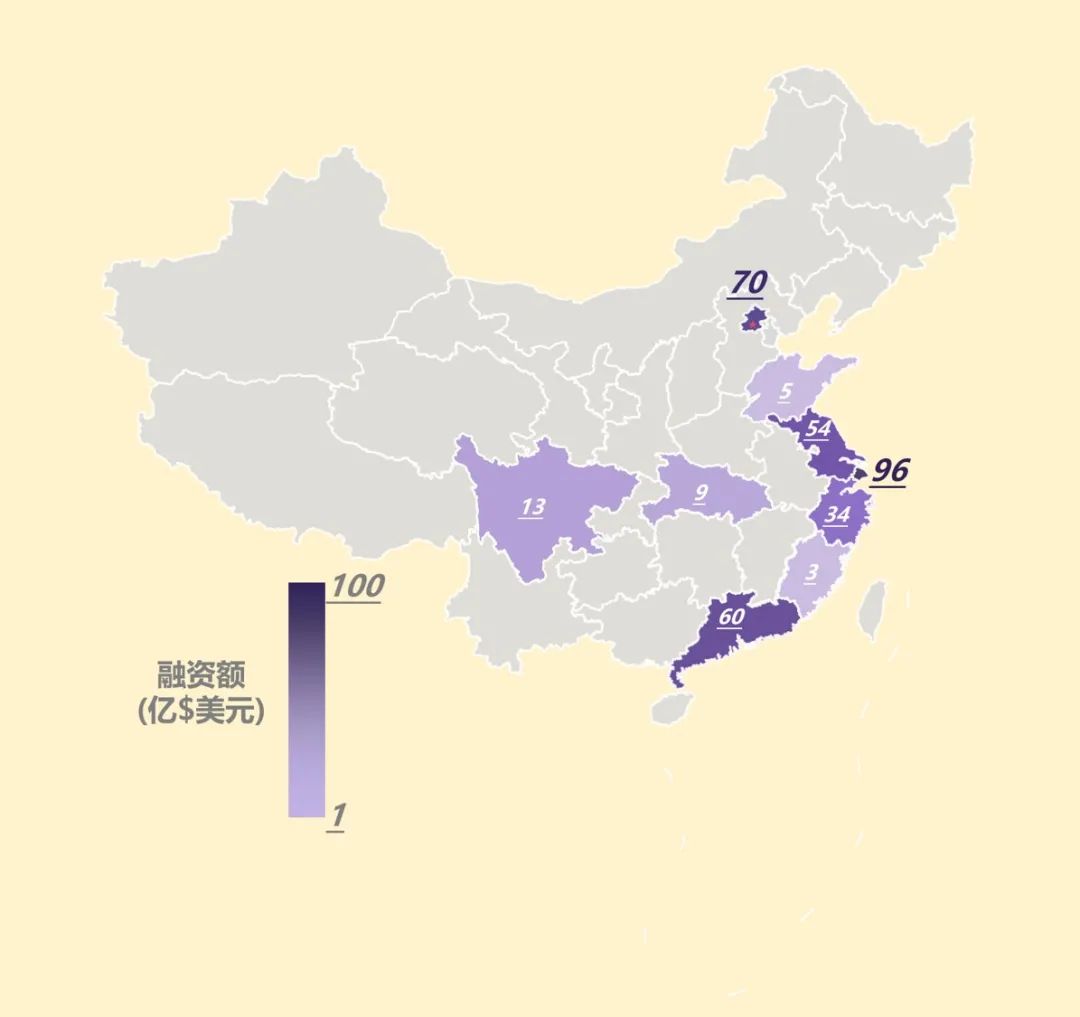

the five hot financing areas in China have not changed much, and the five regions with the most active financing activities are Shanghai, Beijing, Guangdong, Jiangsu and Zhejiang. Shanghai topped the list of total financing with about US $9.6 billion in 2021, surpassing Beijing with a growth rate of 46%, followed by Beijing and Guangdong in total financing. Guangdong and Jiangsu, with the help of Guangdong, Hong Kong and Macao Bay Area and biological island and other industrial clusters, Suzhou biomedical industry highland spillover benefits, still maintain a growth rate of nearly 60%. It is worth noting that Sichuan and Hubei, ranked 6 and 7, as emerging development places, maintained high growth rates of 281 per cent and 134 per cent, respectively.

Figure 3: Distribution of financing in China's pharmaceutical and health industry

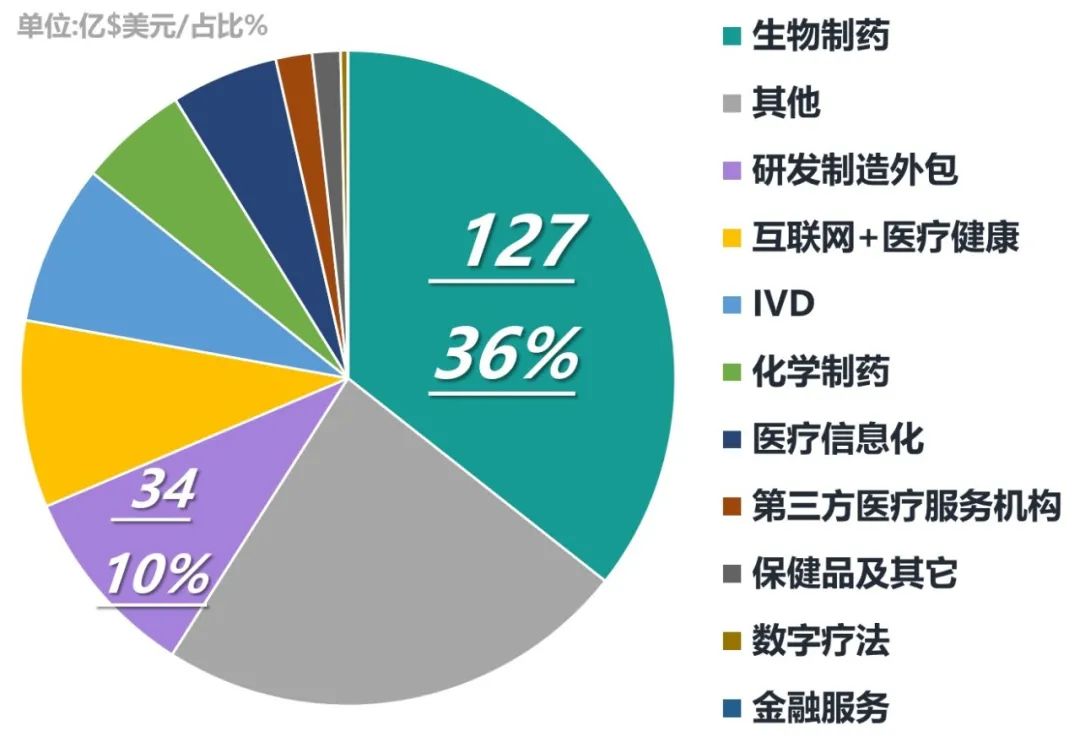

Investment Sector: The absolute leadership of biopharmaceuticals remains unchanged.

this year, China's biomedical industry has maintained its leading position in the national medical and health segment by virtue of its absolute advantage of "double first" in the amount of financing and the number of financing events. 36% of the total industry, while R & D and manufacturing outsourcing accounted for 10% of the total, the two are the largest and higher growth rate of the sub-investment areas.

Figure 4: Distribution of investment sectors in China's pharmaceutical and health industry

Figure 5: Distribution of growth rates of financing by segment

Fine understanding of biological drugs: early projects are mostly, still in the growth stage.

focusing on the biopharmaceutical subdivision, it can be seen that nearly half of the projects are in round B and before, and the industry is still in the growth stage. it is easier for early projects to obtain financing. the average single financing amount of angel round a and round B has risen from us $8 million to 20 million and 40 million, with the valuation doubling on average for each additional round.

Figure 6: Distribution of rounds of biopharmaceutical financing in China in 2021

the head effect is obvious, good project is not bad for money

financing ranges from one million to more than one billion US dollars. The median amount of disclosed financing is about 14 million. The investor with the most "good money" in 2021 invested 1.5 billion US dollars in the strategic investment of Ruige Pharmaceutical for Lilly. From the investors of the top 10 biopharmaceutical companies in the financing amount, it can be seen that good targets will generally be invested by multiple head institutions, with obvious head effect. The biopharmaceutical investment area focuses on anti-tumor antibody drugs, vaccines and new therapies including nucleic acid drugs.

Figure 7:2021 China Biopharmaceutical Top10 Financing List

2022 focus direction outlook: embrace innovation, focus on high-business track.

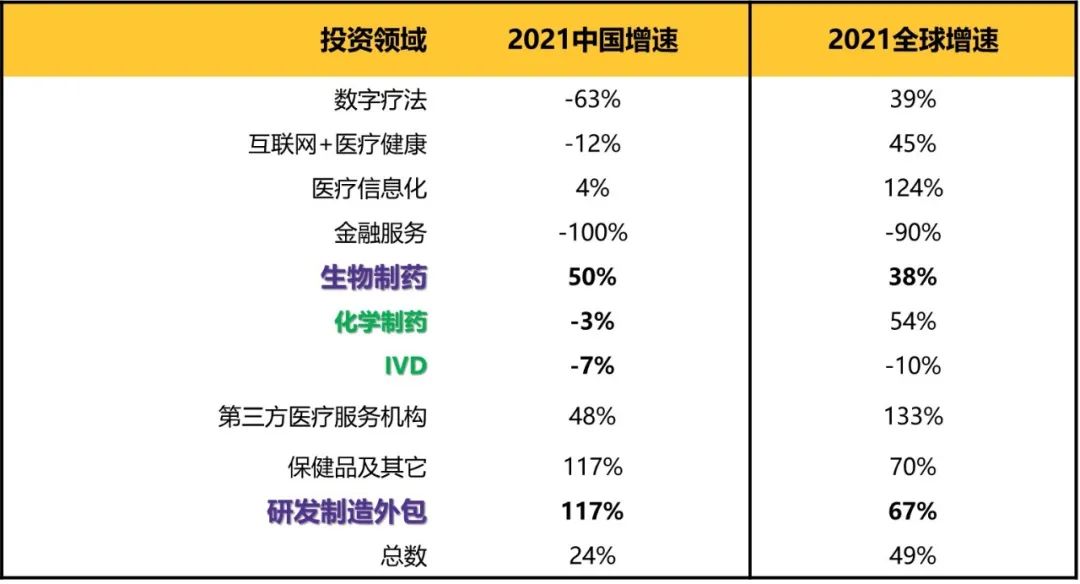

The biopharmaceutical and R & D and manufacturing outsourcing (CXO), which is closely related to the biopharmaceutical sector, has continued its previous high growth trend and has become a hot sector with the highest growth rate in many investment fields and the domestic growth rate exceeds that of the world. It is still in the growth stage in the industry development cycle and is still the hot direction in the future, in addition, chemical pharmaceuticals and IVD have changed from positive growth to negative growth in 2020 under the influence of policies such as encouraging innovation transformation and incorporating centralized procurement. The medical reform policy is an invisible hand, which has a deep impact on the market pattern, and the future expectation is not optimistic. With the entry of biopharmaceuticals into the collection, it will also be affected by price pressure to a certain extent, forcing local enterprises to seek more change and transformation.

Figure 8: China growth vs. global growth by segment